Sep 18th, 2024

Watch the video short here

The financial industry has come a long way from the days of open outcry trading pits. Today's markets are dominated by electronic trading, algorithmic strategies, and high-frequency trading. This evolution has brought unprecedented speed and efficiency, but it has also introduced new risks and complexities. Regulatory bodies worldwide have responded with stringent requirements aimed at maintaining market stability and protecting investors. Rules such as FINRA Rule 15c3-5 in the United States and MiFID II in Europe mandate strict oversight of trading activities, placing the onus on firms to implement comprehensive risk controls and is an area that can’t afford to be overlooked.

In our webinar, "Trading Safeguards: Enhancing Security with OMS Risk Controls," we explore the importance of risk controls within Order Management Systems (OMS) for firms navigating complex market regulations.

A Diverse Audience with Common Challenges

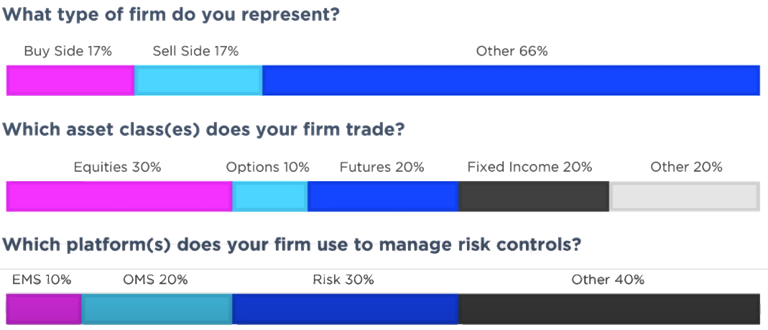

The webinar audience reflected the diverse nature of today's trading ecosystem, comprising a mix of buy-side and sell-side firms. Notably, many participants reported a focus on equities and options trading, two asset classes that often require nimble risk management due to their volatility and complexity. The audience played a key role in shaping the content of our webinar as we tailored the examples and use cases presented accordingly.

A key insight from the audience polls was the prevalence of multiple risk platforms within individual firms. This fragmentation of risk management tools is a common challenge in the industry, and further emphasizes the need for a centralized risk management framework.

Importance of Risk Controls in OMS

At the core of the webinar discussion was the vital role that risk controls play within an OMS. These controls serve multiple crucial functions:

Error Prevention: One of the most immediate benefits of robust risk controls is the prevention of costly mistakes. "Fat-finger" trades, where a trader accidentally enters an order of incorrect size or price, can lead to significant financial losses and market disruptions. Properly implemented risk controls can catch these errors before they impact the market.

Regulatory Compliance: With regulations like FINRA Rule 15c3-5 and MiFID II setting stringent standards for risk management, firms must ensure their systems can meet these requirements. An OMS with integrated risk controls provides a centralized platform for implementing and demonstrating compliance.

Exposure Management: In today's multi-asset trading environment, firms need to manage their exposure across various instruments and markets. Risk controls within an OMS can provide real-time visibility into a firm's overall risk position, allowing for more effective risk management.

Real-Time Monitoring and Alerts: The speed of modern markets requires equally rapid risk assessment. OMS risk controls can provide real-time monitoring and instant alerts when predefined risk thresholds are approached or breached, allowing for swift action to mitigate potential issues.

The Pitfalls of Fragmented Risk Management

While the need for comprehensive risk management is clear, many firms struggle with fragmented systems that hinder rather than help. The webinar highlighted several challenges associated with managing risk across multiple platforms including fragmented data, inconsistent risk assessments, and increased operational complexity. These issues can lead to gaps in risk coverage and difficulties in ensuring comprehensive compliance with regulatory standards. Centralizing risk controls within a single OMS addresses these challenges by providing a unified view of risk exposure across all asset classes and trading activities. A centralized OMS streamlines risk management processes, enhances data accuracy, and facilitates more efficient regulatory reporting. It also enables real-time monitoring and more effective implementation of risk controls, ensuring that firms can respond swiftly to potential threats and maintain a secure trading environment.

Conclusion

As the financial markets continue to evolve, the importance of robust, centralized risk management will only grow with integrated risk controls within an OMS playing a significant role in addressing the complex challenges currently facing trading firms.

By centralizing risk controls, firms can enhance their ability to prevent errors, ensure regulatory compliance, manage exposure effectively, and maintain a secure trading environment. As we look to the future, it's clear that those firms who prioritize and invest in advanced risk management solutions will be best positioned to navigate the complexities of the global financial landscape, protect their interests, and capitalize on new opportunities as they arise. Watch the full webinar recording for a more in-depth view of centralized risk controls in the OMS.

About Sterling Trading Tech

At Sterling Trading Tech, we specialize in delivering a comprehensive suite of professional trading technology solutions tailored to meet the diverse needs of the global capital markets. Our product offerings include advanced trading platforms, a sophisticated risk and margin system, and our flagship OMS. These products are designed to provide unparalleled efficiency, security, and flexibility for market participants, enabling them to execute trades with precision and confidence. Our trading platforms support a wide range of asset classes, while our risk and margin system offer robust tools for managing exposure and maintaining compliance with regulatory standards. The OMS, the focus of our recent webinar, integrates seamlessly with other systems to provide a centralized solution for order execution and risk management. Together, these products empower firms to optimize their trading operations and navigate the complexities of the modern financial landscape.

Links and Contact Information:

We look forward to learning more about your trading needs.

Market Asymmetry Before It Moves You

In today’s markets, sharp price moves rarely come out of nowhere. They build quietly ...

Sterling OMS 360: A New Era in OMS

The newly launched OMS provides the only real-time margin and multi-asset capability during ...

The Intersection of Pre- and Post-Trade Risk

Effective risk management is paramount in today's fast-evolving financial landscape. Firms ...

Sterling Trading Tech wins Best Listed Derivatives Trading Platform in APAC - Recognized at the A-Team Capital Markets Technology Awards APAC 2025

Sterling Trading Tech (Sterling), a leading provider of professional trading technology ...