Enforce Reg T and Portfolio Margin at every stage of the trade lifecycle.

Pre-trade validation of Excess, SMA, PDT, and PM ensures orders never exceed buying power.

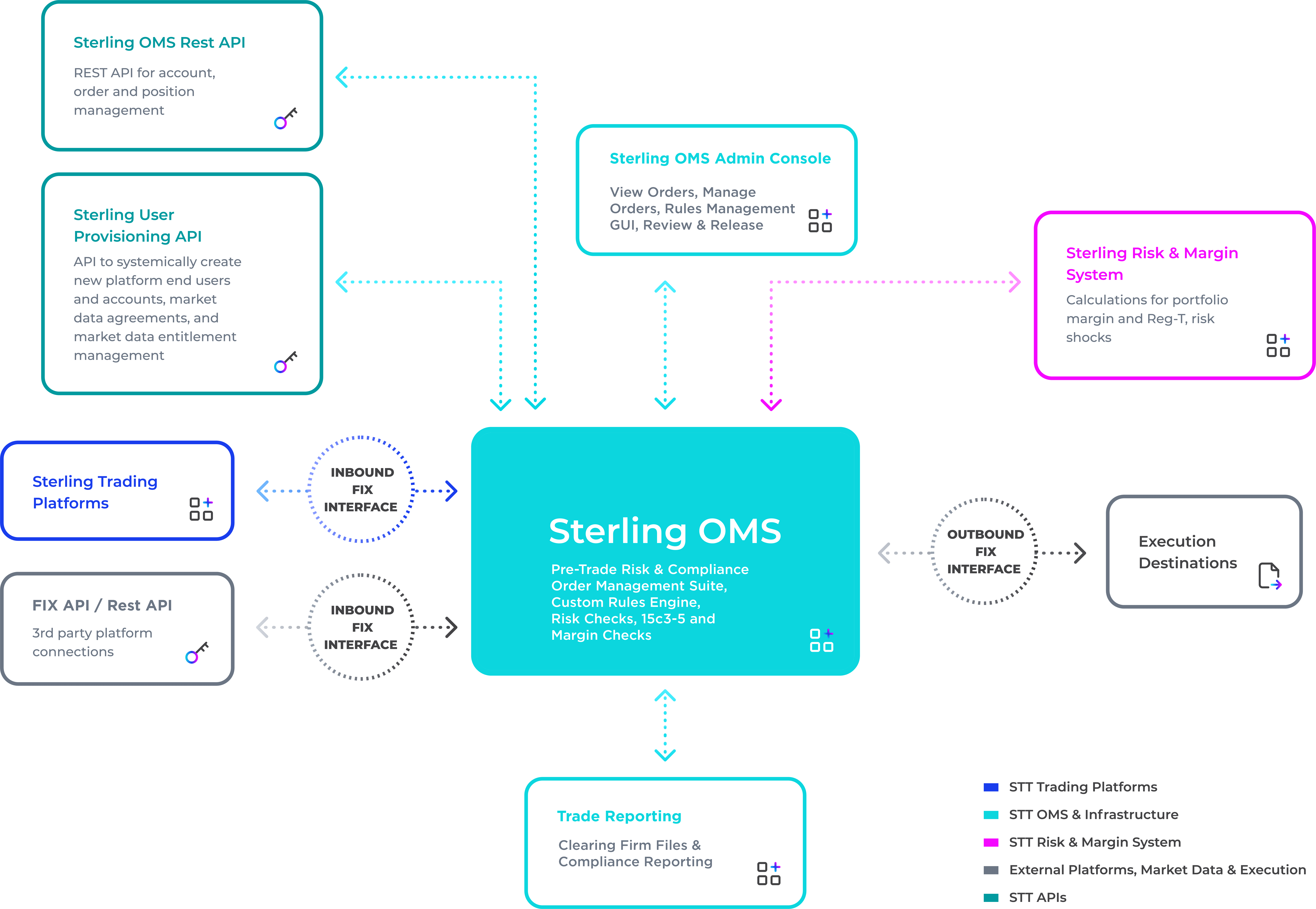

Connect easily with FIX, APIs, and Sterling Risk Manager for real-time margin transparency across your trading stack.

Trusted by trading firms and clearing brokers to prevent margin calls and regulatory breaches.

Global connectivity to multiple exchanges and trading networks along with on demand custom development solutions.

Most OMS platforms only calculate margin at end-of-day or provide limited pre-trade checks.

How we help: Sterling OMS 360 delivers real-time Reg T and Portfolio Margin enforcement with multi-leg spread recognition and the Universal Spread Rule built in.

SEC 15c3-5 and FINRA 4210 require strict pre-trade validation. Many systems fall short.

How we help: Sterling OMS 360 performs pre-trade checks for Excess, SMA, PDT, and PM at both firm and account levels.

Delayed P&L and account updates slow decision-making and reduce trading agility.

How we help: Sterling OMS 360 provides real-time publishing of account status and trades through REST API or WebSockets.

Restricted venue access and lack of overnight trading limit opportunities.

How we help: Sterling OMS 360 connects to 100+ venues and includes integrated Blue Ocean ATS for 24x5 overnight trading.

| Feature | Sterling OMS 360 | Competitor A | Competitor B | Competitor C |

|---|---|---|---|---|

| Real-Time Reg T Enforcement | ✅ |

⚠ |

⚠ |

❌ |

| SMA & PDT | ✅ |

❌ |

❌ |

❌ |

| Portfolio Margin (OCC CPM/TIMS) | ✅ |

❌ |

❌ |

❌ |

| Universal Spread Rule | ✅ |

⚠ |

⚠ |

❌ |

| Risk Engine Integration | ✅ |

⚠ |

⚠ |

✅ |

This diagram shows exactly where Sterling OMS 360 fits between trading platforms, risk management, and execution venues-bringing compliance, margin enforcement, and connectivity together in one system.

We look forward to learning more about your trading needs.