The Sterling Risk & Margin System allows firms to monitor client Reg T, portfolio margin and custom house policy requirements in real-time. View advanced post-execution risk analytics for US and global equities, options and futures.

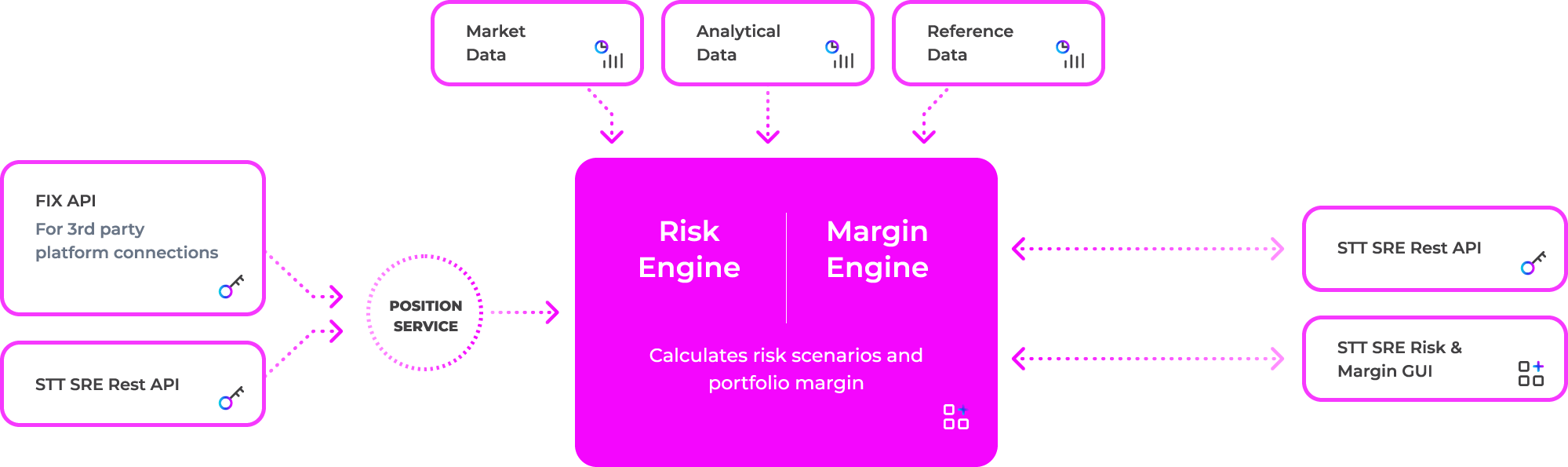

Robust, real time, post trade market risk and regulatory margin haircut calculation system. The Sterling Risk Engine is completely API accessible as well as web-based, delivered and built on a full-featured, flexible and modern GUI.

Analyze risk and Greeks under various scenarios of underlying and volatility moves.

Historical VaR of 500 scenarios with full revaluation.

Two risk factors are included in the historical simulation – underlying move scenarios and implied volatility move scenarios

Standard implementation is completely SaaS based with no need for clients to install any hardware or software on premises.