The U.S. options market is a dynamic and rapidly growing space, presenting unparalleled opportunities for APAC firms. However, its growth is coupled with significant complexities that demand strategic preparation and advanced technology solutions. Unlike equities markets, where trading is predominantly order-driven, the U.S. options market operates under a quote-driven structure that depends on market-makers to ensure liquidity across thousands of strikes and expirations. Combined with fragmented liquidity and stringent regulatory requirements, this unique structure makes navigating the U.S. options market particularly challenging.

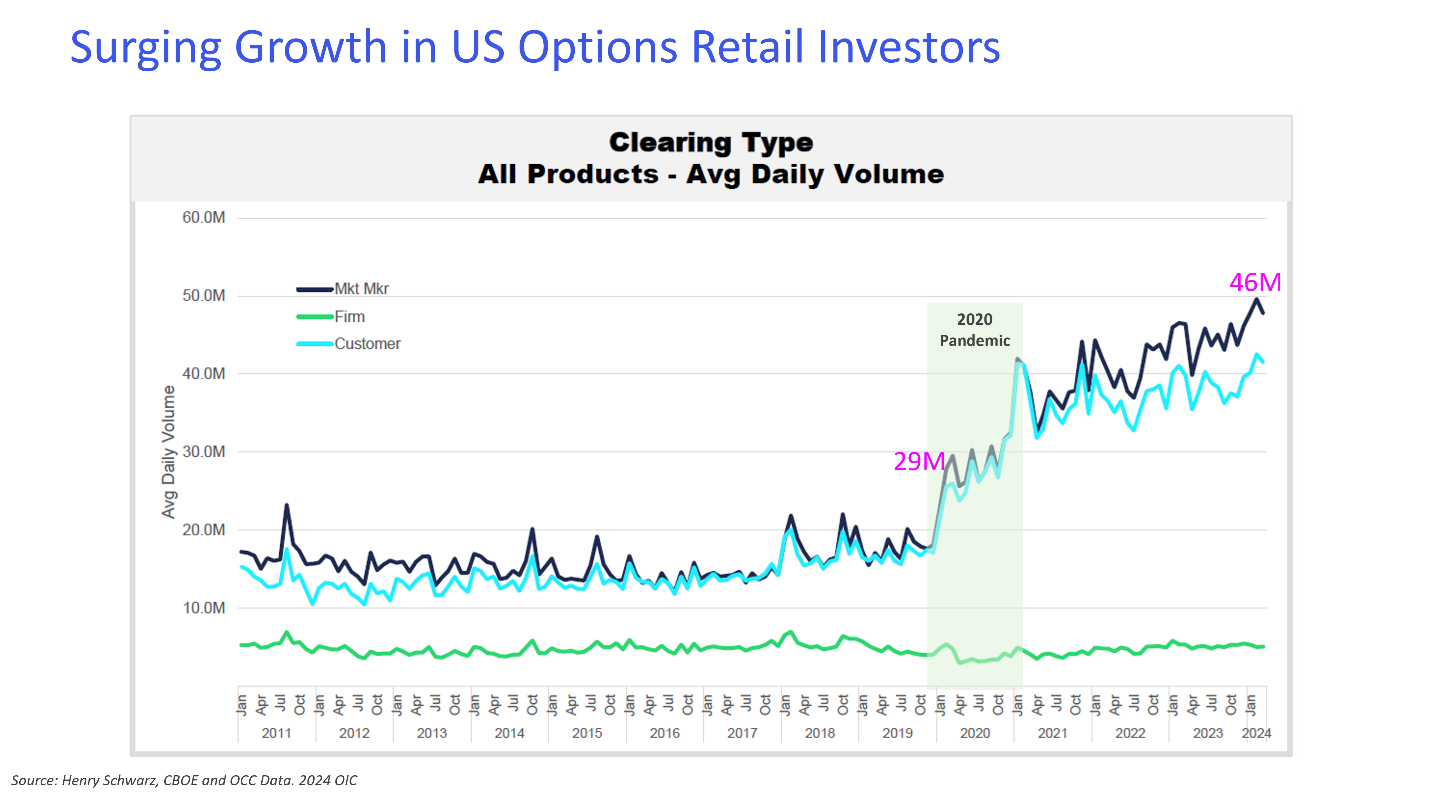

For APAC-based firms aiming to capitalize on the growth of U.S. options, mastering these complexities is essential. Innovations like zero-days-to-expiration (0DTE) options and rising retail participation have further intensified market activity, presenting both risks and opportunities. For APAC firms to thrive, it is essential to address fragmented liquidity, ensure regulatory compliance, and implement real-time risk management solutions. Leveraging advanced systems, such as Sterling Trading Tech’s OMS, can simplify these complexities and support efficient and effective market participation.

Understanding the Challenges

The U.S. options market stands apart from other financial markets due to its inherent complexity. Fragmented liquidity is a significant hurdle, with trading spread across 16 lit exchanges competing for order flow. This dispersion necessitates sophisticated systems capable of seamless order routing to ensure optimal execution across multiple venues.

Adding to the challenge is the vast array of strikes and expirations. Unlike equities, where each stock represents a single asset, options trading involves thousands of variations per underlying asset, driven by multiple expiration dates, strike prices, and contract types (calls and puts).Firms must navigate this complexity with systems that handle high trade volumes while maintaining precision and speed in execution.

Regulatory compliance poses another major obstacle. The U.S. market enforces stringent rules from agencies like the SEC, FINRA, and the OCC. Pre-trade margin validation, real-time risk monitoring, and post-trade reporting are essential to maintain compliance and safeguard investors. Regulations such as Reg T and portfolio margin calculations require automated, accurate systems to avoid costly errors.

The rise of 0DTE options introduces additional complexity. These high-risk contracts demand real-time risk management and robust controls to ensure clients’ trades align with their risk tolerance. Finally, the quote-driven structure of the market, where market makers play a critical role in providing liquidity, requires firms to have systems that can efficiently interact with these venues while managing unique operational risks.

Strategic Solutions for Effective Market Entry

Implementing a robust order management system can simplify participation in the U.S. options market. An effective OMS should streamline order routing, automate compliance tasks and offer real-time risk assessments. This approach not only improves efficiency but also helps firms manage the complexities of a fragmented market.

Automating compliance processes is equally important. Systems that handle Reg T and portfolio margin calculations can reduce the risk of errors and the operational burden of manual compliance checks.

Scalability is another critical factor. A flexible technology infrastructure allows firms to manage rising trading volumes and the increasing complexity of options strategies. An OMS with an API-first architecture supports seamless integration and growth.

Moving Forward

Mastering the complexities of the U.S. options market is essential for APAC firms seeking transformative growth. By focusing on effective risk management and compliance, firms can build a strong presence in this competitive market.

We look forward to learning more about your trading needs.

Market Asymmetry Before It Moves You

In today’s markets, sharp price moves rarely come out of nowhere. They build quietly ...

Sterling OMS 360: A New Era in OMS

The newly launched OMS provides the only real-time margin and multi-asset capability during ...

The Intersection of Pre- and Post-Trade Risk

Effective risk management is paramount in today's fast-evolving financial landscape. Firms ...

Sterling Trading Tech wins Best Listed Derivatives Trading Platform in APAC - Recognized at the A-Team Capital Markets Technology Awards APAC 2025

Sterling Trading Tech (Sterling), a leading provider of professional trading technology ...