Dec 10th, 2024

Watch the video short here.

In an era where market volatility and regulatory scrutiny are intensifying, financial firms face mounting pressure to fortify their trading operations. The recent webinar, "Trading Safeguards: Enhancing Security with OMS Risk Controls," sheds light on how advanced Order Management Systems (OMS) are evolving to meet these challenges head-on. As markets become increasingly interconnected and algorithmic trading continues to dominate, the potential for cascading errors and systemic risks grows. Traditional risk management approaches are struggling to keep pace with the speed and complexity of modern trading environments. This is where next-generation OMS platforms are stepping in, offering a new paradigm in risk control and compliance management.

Group and Account-Level Risk Controls

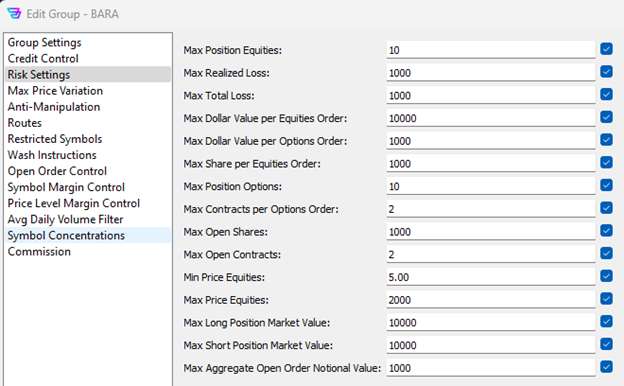

One of the standout features demonstrated in the webinar was the ability of the OMS to implement risk controls at both group and account levels. This multi-tiered approach addresses a critical need in the industry: the ability to apply broad risk parameters across multiple accounts while simultaneously allowing for precise, account-specific controls.

For instance, a firm might set general price risk thresholds at the group level to catch obvious "fat finger" errors across all accounts. Simultaneously, they can implement stricter limits on individual accounts based on factors such as trading strategy, client risk tolerance, or regulatory requirements. This granularity enables firms to tailor their risk management approach to the specific needs of different trading desks or client segments, enhancing overall risk mitigation without sacrificing flexibility.

Group and Account-Level Risk Controls

The webinar's demonstration segment brought theory into practice, showcasing how the OMS handles various risk scenarios in real-time. Here's a breakdown of the key controls demonstrated:

Price Risk Controls: The system's ability to detect and manage price discrepancies is crucial in preventing costly errors. By flagging orders that deviate significantly from current market prices, the OMS serves as a first line of defense against unintended market impact and potential regulatory scrutiny.

Size Risk Management: With the growing prevalence of high-frequency and algorithmic trading, managing order sizes has become increasingly complex. The OMS demonstrated its capability to monitor and restrict order sizes based on predefined thresholds, helping firms avoid unintended large positions that could lead to liquidity risks or market disruptions.

Duplicate Order Detection: In high-speed trading environments, the risk of duplicate orders due to system glitches or human error is a real concern. The OMS's ability to identify and prevent such occurrences not only protects the firm from unnecessary exposure but also contributes to overall market stability.

Side Risk Controls: Accurate trade classification is essential for regulatory compliance and effective position management. The demonstration highlighted how the OMS verifies trade directions, ensuring that positions are correctly opened or closed and preventing violations of regulations such as those prohibiting naked short selling.

The Future-State of Trading Risk Management

As we look to the future, the role of OMS platforms in risk management is set to expand. With the increasing integration of artificial intelligence and machine learning, these systems will likely become more predictive, potentially identifying risk patterns before they manifest into significant issues.

As regulatory frameworks continue to evolve in response to market changes, OMS platforms will need to adapt quickly. The flexibility demonstrated in the webinar suggests that advanced OMS solutions are well-positioned to incorporate new compliance requirements seamlessly, helping firms stay ahead of regulatory curves.

Empowering Traders in a Complex Market Ecosystem

The demonstration of Sterling OMS offers a glimpse into how technology is reshaping risk management in the trading industry. By providing traders and risk managers with powerful, customizable tools, such systems are not just safeguarding individual firms but contributing to the overall stability and integrity of financial markets. Firms that leverage these advanced OMS features will be better equipped to navigate the complexities of modern markets, balancing the need for agility with the imperative of risk control.

For those interested in exploring how Sterling OMS risk controls can be applied to their specific trading operations, we encourage you to watch the full webinar. For a personalized consultation or to schedule a demo, please contact us here.

We look forward to learning more about your trading needs.

Market Asymmetry Before It Moves You

In today’s markets, sharp price moves rarely come out of nowhere. They build quietly ...

Sterling OMS 360: A New Era in OMS

The newly launched OMS provides the only real-time margin and multi-asset capability during ...

The Intersection of Pre- and Post-Trade Risk

Effective risk management is paramount in today's fast-evolving financial landscape. Firms ...

Sterling Trading Tech wins Best Listed Derivatives Trading Platform in APAC - Recognized at the A-Team Capital Markets Technology Awards APAC 2025

Sterling Trading Tech (Sterling), a leading provider of professional trading technology ...