Watch the video short here.

As financial markets grow more complex, Order Management Systems (OMS) have become critical tools at the intersection of high-speed trading and risk management. These systems now serve as sophisticated gatekeepers, using advanced risk checks to maintain market integrity while optimizing operational efficiency. The evolution of OMS technology reflects the changing demands of modern trading environments, where speed and safety must coexist.

In our webinar, "Trading Safeguards: Enhancing Security with OMS Risk Controls," we analyze the mechanics of risk checks within the Sterling OMS. This exploration goes beyond the surface of day-to-day trading, revealing the intricate balance of algorithms and fail-safes that underpin the modern financial infrastructure. Learn how these systems not only protect individual firms but also contribute to the overall resilience of global markets.

Risk checks are the first defense against erroneous trades whether they result from simple mistakes such as typing errors or more complex issues like misinterpreted trading strategies. By verifying orders against predefined criteria before execution, these checks ensure that trades comply with internal policies and regulatory requirements.

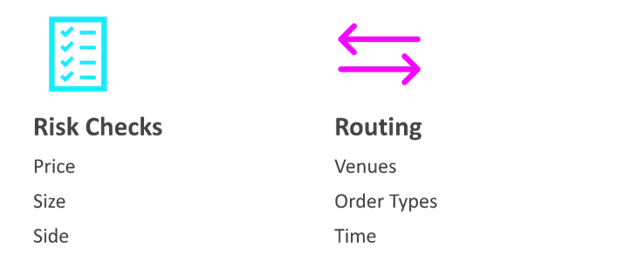

Integrating advanced risk management features enables the Sterling OMS to effectively minimize financial losses and prevent market disruptions. The discussion explored various categories of risk checks integral to modern OMS platforms, such as price, size, and operational risk controls. These tools are invaluable for ensuring that all trading activities are carried out within the firm's risk tolerance and in accordance with legal and regulatory frameworks.

Common Types of Risk Checks in an OMS

An OMS typically implements several types of risk checks, each targeting different aspects of a trade and designed to protect both traders and markets. Let's explore some of the most common risk checks implemented in OMS platforms:

Price checks: One of the most common types of risk checks, they ensure that the price entered does not deviate excessively from the current market price, thus preventing the classic "fat finger" error, where extra zeros might inadvertently be added to an order.

Size checks: Although functionality is similar to price checks, there is a stronger focus on the trade quantity, ensuring that the order size is within acceptable limits and preventing unintended large-scale trades. These checks are essential for managing exposure and liquidity risks, as they help maintain order sizes that the market can absorb without significant price impact.

Operational risk checks: A critical category addressing the logistical and procedural aspects of trading. These checks encompass a range of critical verifications, such as confirming a trader's authorization for short-selling specific securities and ensuring accurate position marking for reporting and compliance. In derivatives trading, for instance, these safeguards can prevent costly errors like inadvertently opening new positions instead of closing existing ones, thus mitigating the risk of unexpected financial exposure.

Business Impact of Risk Checks

Risk checks in an OMS offer significant benefits contributing to the overall health and stability of firms and markets. Here are some key benefits of incorporating comprehensive risk checks in an OMS:

Error prevention: By setting up automated checks for price, size, and other key parameters, the OMS can detect and prevent trades that fall outside acceptable thresholds.

Market integrity: These checks help maintain overall market stability by reducing the likelihood of disruptive trades.

Regulatory compliance: Risk checks assist firms in meeting the stringent requirements set by financial authorities

Financial protection: By catching potential errors before they impact the market, risk checks safeguard firms from costly mistakes and potential losses.

Enhanced precision: The ability of an OMS to automatically enforce limits and constraints offers a level of accuracy that manual processes cannot match.

Trust building: Implementing thorough risk checks demonstrates a commitment to responsible trading practices, building trust with clients and regulators.

By employing these risk checks, firms can significantly reduce the occurrence of erroneous trades and enhance investor confidence by demonstrating a commitment to robust risk management practices.

Conclusion

Firms must leverage their OMS not just as transaction processors, but as strategic assets for risk mitigation and growth. This requires a multifaceted approach: regularly updating risk check parameters, investing in staff training, integrating OMS data with broader analytics platforms, collaborating with providers for customized solutions, and establishing clear roadmaps for scaling capabilities. By viewing the OMS as an integrated tool that can adapt to changing market conditions and internal risk appetites, companies can better navigate market challenges while building a foundation for sustainable expansion. This proactive stance not only enhances risk management and operational efficiency but also positions firms to capitalize on future opportunities. For a deeper dive into these strategies and their implementation, watch the full webinar: here.

Watch the video short here.

We look forward to learning more about your trading needs.

Market Asymmetry Before It Moves You

In today’s markets, sharp price moves rarely come out of nowhere. They build quietly ...

Sterling OMS 360: A New Era in OMS

The newly launched OMS provides the only real-time margin and multi-asset capability during ...

The Intersection of Pre- and Post-Trade Risk

Effective risk management is paramount in today's fast-evolving financial landscape. Firms ...

Sterling Trading Tech wins Best Listed Derivatives Trading Platform in APAC - Recognized at the A-Team Capital Markets Technology Awards APAC 2025

Sterling Trading Tech (Sterling), a leading provider of professional trading technology ...