Jan 12th, 2023

It has been a whirlwind few months since I joined STT, and now that the dust has settled, I'm struck by all that our team accomplished in 2022, both before and after my arrival. From the record growth of our OMS to the introduction of FX and crypto to our risk and margin system, our many significant hires and our return to visiting clients in their offices, to say that it has been a busy – and rewarding – year would be an understatement.

We are eyeing 2023 with a sense of excitement and optimism, but also with an acknowledgement of the technological and business pressures our clients are facing. The good news is that we are in a better position than ever to meet these needs.

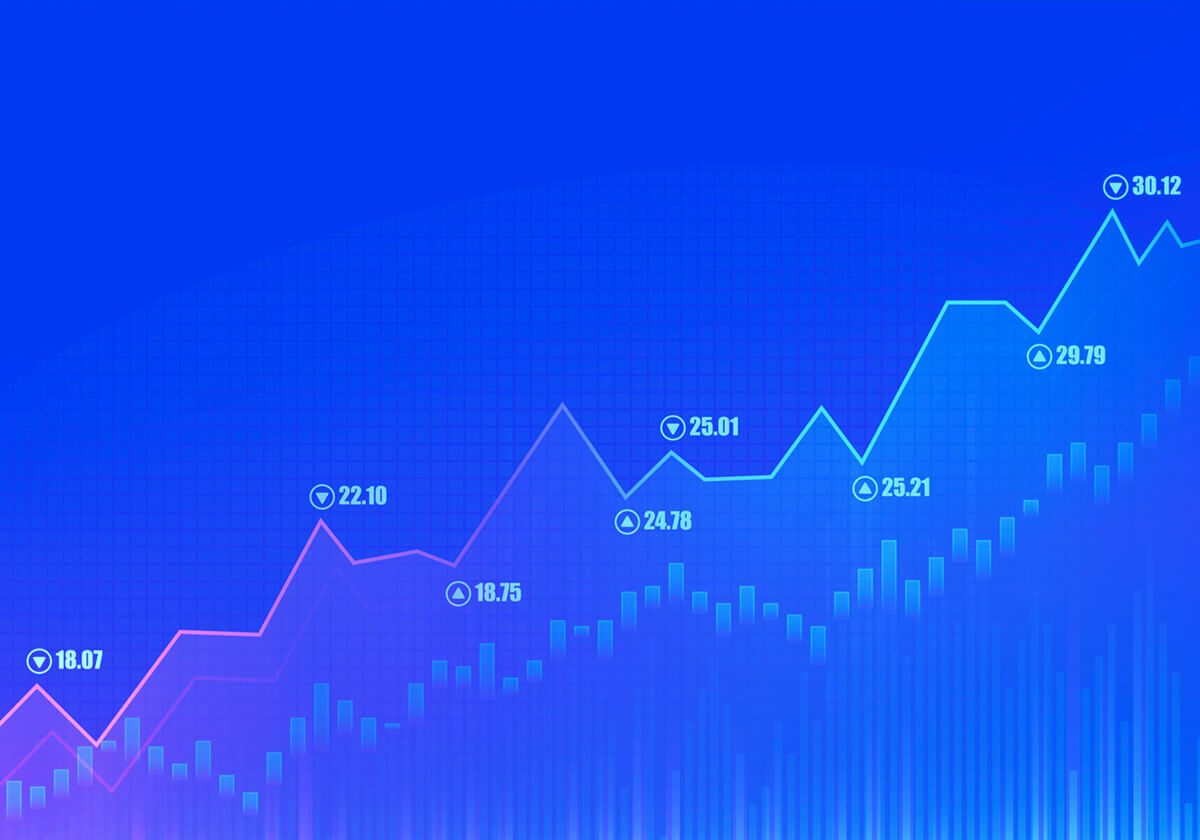

Today's market participants are facing no shortage of challenges. Increasing competition has magnified the importance of speed and innovation, while the spike in options volumes means firms must adapt to this demand to maximize their market share. Ever-intensifying compliance requirements are among several factors heightening the need for operational efficiency. All this is occurring amid an increasingly untenable backdrop of industry-wide frustration with legacy systems for order management and risk, which are plagued by outmoded technology, limited capacity and slow client service and response times.

At STT, we envision an industry landscape where participants can stop losing sleep over these headwinds and focus more of their energy on differentiation – and we're laser-focused on building and enhancing products that can help our clients accomplish exactly that. Our sophisticated risk and margin system is a compelling example, making it no surprise that we've seen such momentum around that part of our business.

For instance, while many market participants are equipped to stand up limited functionality for risk and margin, this capability diminishes rapidly as the business expands. Today, many firms that started in the equities space are looking to pivot to options, while others that already have derivatives desks want to branch out to multi-leg strategies. At each stage, the necessary margin calculations become exponentially more complex, especially as they must be Reg T-compliant and reflect custom house policies.

All of these capabilities are a direct result of our investment in our industry-leading technology combined with a partnership approach. We engage deeply with our clients, listening intently to their challenges and working closely with their teams. The result is accelerated time to market, enabling our clients to adapt to any challenge with greater precision and more resources to focus on value-adding work. Additionally, we are closely following the SEC's recent market structure proposals and how they will impact our clients and their businesses.

The aforementioned capabilities on risk and margin are just a few examples. Highly targeted enhancements that streamline onboarding, operations, calculations and more will continue to define our product roadmap for 2023 and beyond. We are also readying the rollout of an entirely new foundational architecture that will act as the bedrock of all our technologies and make it even easier for clients to access and leverage our tools to fuel their growth.

As we're actively hiring for several areas of our business, from business development to product to systems implementation, we're focusing our search on talented, driven individuals who are as passionate about helping our clients reach the next level as we are. I still consider myself a newcomer to STT, and I've already been blown away by the level of commitment, expertise and desire our team demonstrates every day. Now it's time to build on that.

No matter what challenges you're facing, we remain committed to innovation and delivering comprehensive solutions to help you navigate both the markets and the current business environment. Our ultimate vision for 2023 is to continue to serve as the industry's leading provider of OMS, risk and margin technology, and we're working on an array of strategic priorities to that end. Watch in the weeks and months ahead as we share more details.

We look forward to learning more about your trading needs.

Market Asymmetry Before It Moves You

In today’s markets, sharp price moves rarely come out of nowhere. They build quietly ...

Sterling OMS 360: A New Era in OMS

The newly launched OMS provides the only real-time margin and multi-asset capability during ...

The Intersection of Pre- and Post-Trade Risk

Effective risk management is paramount in today's fast-evolving financial landscape. Firms ...

Sterling Trading Tech wins Best Listed Derivatives Trading Platform in APAC - Recognized at the A-Team Capital Markets Technology Awards APAC 2025

Sterling Trading Tech (Sterling), a leading provider of professional trading technology ...