Jul 13th, 2017

Sterling Trading Tech (STT) announced today that its professional trading platforms are now available from Interactive Brokers Group (IB), one of the largest global broker-dealers. Under terms of the agreement, individual traders can now use the STT suite of trading platforms to trade with an IB account.

Sterling Trading Tech (STT) is a leading provider of trading platforms, risk and compliance technology and trading infrastructure products for the global equities, equity options, and futures markets.

“We are thrilled to start this new relationship with Interactive Brokers. As an industry leader, STT has stayed on the forefront of the ever-changing global market environment by understanding the complex needs of our customers. Our relationship with Interactive Brokers opens up exciting possibilities for active traders on a global scale by giving them the opportunity to use our professional trading platforms,” states Jim Nevotti, President of STT.

STT’s premier trading platforms; Sterling Trader Pro, Sterling Trader Elite and Sterling VolTrader will be available on IB. Sterling Trader Pro is used by over 5,000 professional traders worldwide to trade equities, options, and futures. Sterling Trader Elite is used by buy-side firms and hedge funds that need superior trading technology and sophisticated order management. Sterling VolTrader (formerly CBOE’s Livevol X platform) is one of the most advanced option analysis platform available with portfolio analysis, sophisticated volatility modeling tools, and complex option order entry.

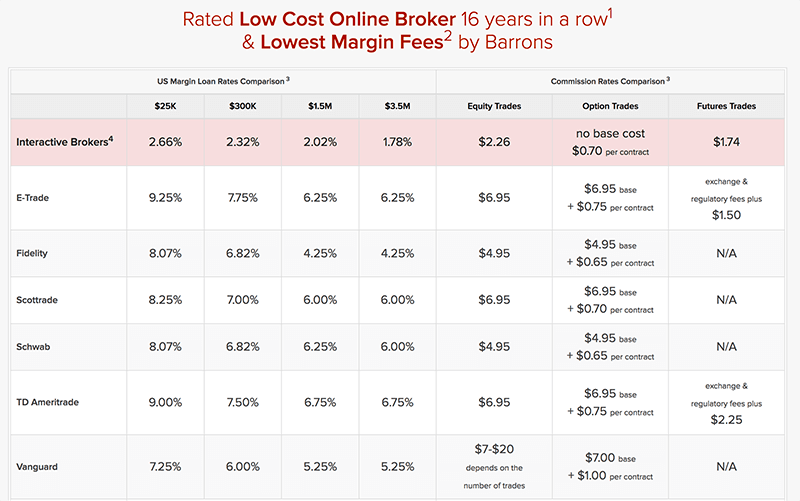

Interactive Brokers provides direct market access to over 120 market destinations and associated clearing and custodial services. The firm is well known for its low commissions and financing rates and for not selling or trading against its customers’ orders.

To learn more about Interactive Brokers please visit: https://www.interactivebrokers.com/en/index.php?f=1340#low-cost.

We look forward to learning more about your trading needs.

Sterling OMS 360: A New Era in OMS

The newly launched OMS provides the only real-time margin and multi-asset capability during ...

The Intersection of Pre- and Post-Trade Risk

Effective risk management is paramount in today's fast-evolving financial landscape. Firms ...

Sterling Trading Tech wins Best Listed Derivatives Trading Platform in APAC - Recognized at the A-Team Capital Markets Technology Awards APAC 2025

Sterling Trading Tech (Sterling), a leading provider of professional trading technology ...

Post-Trade Market Risk and Surveillance

In a financial world where volatility has become the norm rather than the exception, ...