Sep 25th, 2024

Watch the video short here

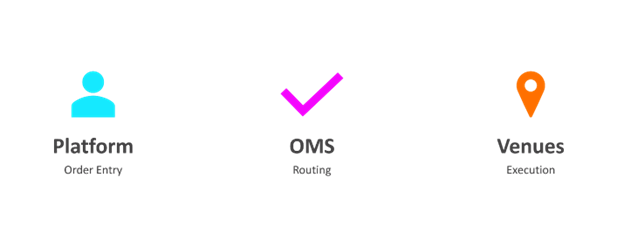

In electronic trading, grasping an order's path from creation to execution is essential for market participants. This journey, often called the "life cycle of an order," encompasses several stages, each playing a vital role in ensuring that trades are executed accurately and efficiently. The process begins with order entry, which can occur through various platforms, including proprietary trading systems, exchange platforms, or specialized solutions. The nuances of the process are pivotal in maintaining market integrity and operational efficiency, making it a necessity for firms to have a durable framework to manage and oversee these stages.

Central to order life cycles is the Order Management System (OMS), which serves as the primary hub for routing orders to their respective destinations. The OMS facilitates the smooth flow of orders and acts as a critical checkpoint for risk management. By examining the role of the OMS in the order life cycle, firms can better appreciate its importance in safeguarding against potential risks and ensuring compliance with regulatory standards.

Analyzing Order Entry

The order entry phase marks the beginning of an order's life cycle in the trading process. This initial step involves inputting the trade details, such as the asset to be traded, the order type, the quantity, and the price. Orders can be entered through various platforms, ranging from in-house proprietary trading systems to established trading platforms. These platforms are designed to handle a high volume of orders precisely and quickly, ensuring that traders can react swiftly to market movements.

Accurate information capture is crucial during this phase to prevent errors that could lead to significant financial implications. For instance, incorrect entry of order details, such as the wrong quantity or price, can result in unintended trades, potentially causing substantial losses. The order entry platform serves as the first line of defense, often incorporating basic checks to ensure that orders meet specific criteria before they are sent for execution. Traders can also specify conditions like time-in-force instructions or execution preferences, adding layers of control and flexibility. The effectiveness of the order entry process directly impacts the overall efficiency and accuracy of trading operations.

The Gatekeeper Function of the OMS

Risk checks and compliance are critical in the trading process, ensuring that all trades align with regulatory standards and internal risk management policies. The OMS typically handles this phase, acting as a gatekeeper before an order proceeds to execution. The OMS performs a series of checks to verify that the order complies with various criteria, such as position limits, credit exposure, and market access rules. These checks are designed to prevent potentially harmful trades, such as those that exceed a trader's authorized limits or violate market regulations.

Compliance with regulatory frameworks, such as FINRA Rule 15c3-5 in the United States and MiFID II in Europe, is integral to these checks. These regulations mandate that firms implement controls to manage risks associated with direct market access, ensuring that all trading activity is appropriately supervised and within the bounds of legal and regulatory requirements. For example, the OMS might flag an order if it involves a restricted security or if it risks breaching pre-established trading limits. The system can then prompt a review or automatically block the order, preventing execution until the issue is resolved.

The OMS's role in risk management extends beyond regulatory compliance to include monitoring real-time changes in market conditions and adjusting risk parameters accordingly. By incorporating automated risk checks and compliance protocols, the OMS enhances the firm's ability to adhere to regulatory standards and provides a robust mechanism for managing operational risks. This approach helps maintain market integrity, protects the firm's financial stability, and ensures that all trading activities are conducted safely and controlled.

The OMS: A Central Hub for Trading Activities

The OMS serves as the central infrastructure through which all trading activities are managed and controlled. Its primary function extends beyond routing orders to various execution venues; it serves as the critical infrastructure for implementing robust risk controls and ensuring regulatory compliance. By automating the enforcement of trading limits, pre-trade risk checks, and compliance protocols, the OMS safeguards against erroneous trades and mitigates potential market disruptions.

Furthermore, the OMS provides traders and risk managers real-time visibility into trading activities, enabling them to make informed decisions and respond swiftly to changing market conditions. This centralized system enhances operational efficiency and fosters a secure trading environment, reinforcing the firm's ability to protect its financial interests.

Conclusion

In conclusion, understanding the intricate life cycle of an order and the crucial role of the OMS is essential for firms seeking to optimize their trading processes and ensure adherence to regulatory standards. For more information about the benefits of an efficient OMS system, watch the full webinar recording.

Follow our social media channels to stay connected with us for the latest updates and insights. Additionally, explore our [Additional Resources] for in-depth articles, whitepapers, and case studies.

Links and Contact Information:

We look forward to learning more about your trading needs.

Market Asymmetry Before It Moves You

In today’s markets, sharp price moves rarely come out of nowhere. They build quietly ...

Sterling OMS 360: A New Era in OMS

The newly launched OMS provides the only real-time margin and multi-asset capability during ...

The Intersection of Pre- and Post-Trade Risk

Effective risk management is paramount in today's fast-evolving financial landscape. Firms ...

Sterling Trading Tech wins Best Listed Derivatives Trading Platform in APAC - Recognized at the A-Team Capital Markets Technology Awards APAC 2025

Sterling Trading Tech (Sterling), a leading provider of professional trading technology ...