STT platforms are used by retail, active and institutional traders worldwide. Our platforms offer the capability and ease to trade multiple asset classes and international markets from a single account.

Trade equities, single and multi-leg options, and futures.

Custom layouts and configurable hotkeys.

Real-time Level I and Level II market data.

Real-time position and P&L management.

Customizable ticker watchlist with over 60 data points per symbol.

Advanced order types, algos and basket trading.

White label STT platforms with your brand.

Charting package with over 90 studies and indicators.

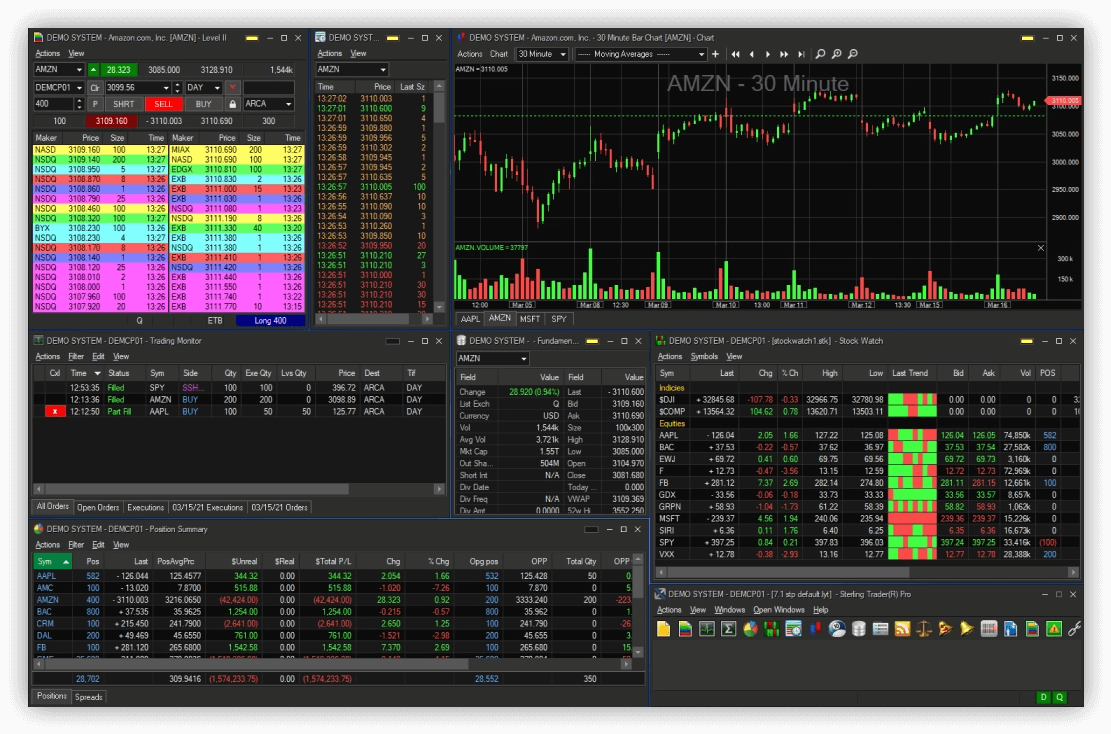

Trade multiple asset classes with the most stable trading platforms in the industry.

Suited for Retail Broker Dealers, Proprietary Trading Firms, Hedge Funds and Institutions

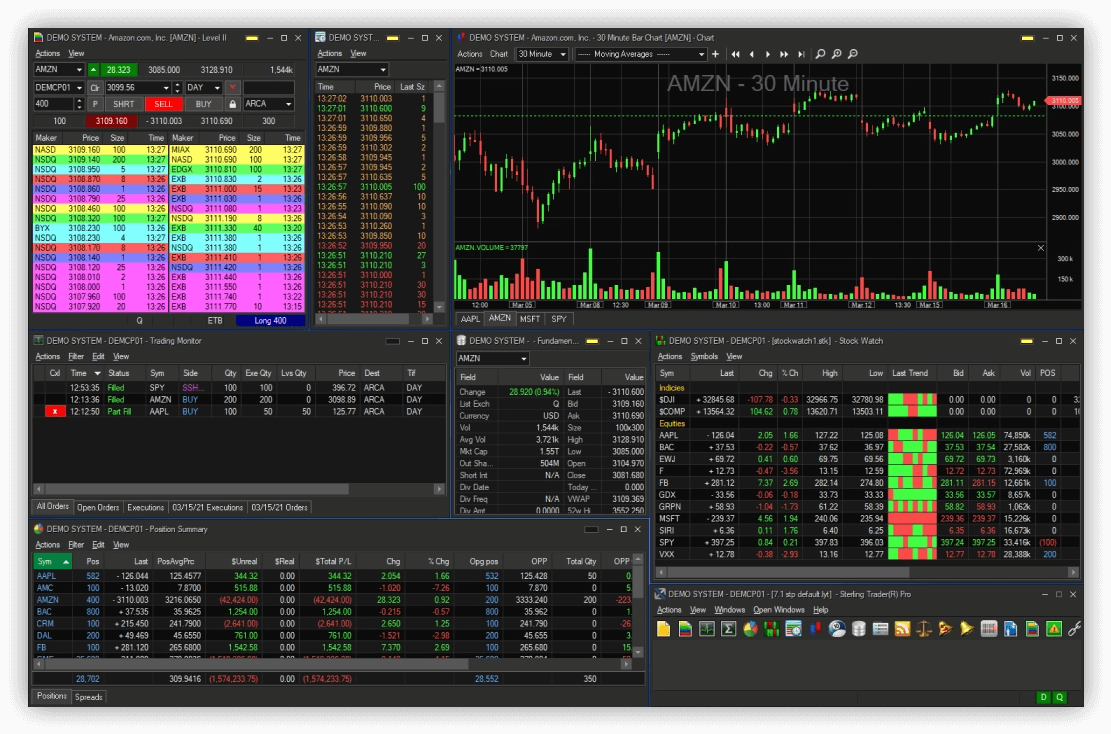

Use the most widely used professional trading platform in the industry for trading equities, options, and futures. Built for speed, stability, and fast executions.

Key platform features

Try the free demo

Try the free demo

Suited for Professional Traders at Institutional Trading Firms, Trading Desks, Hedge Funds, and Family Offices

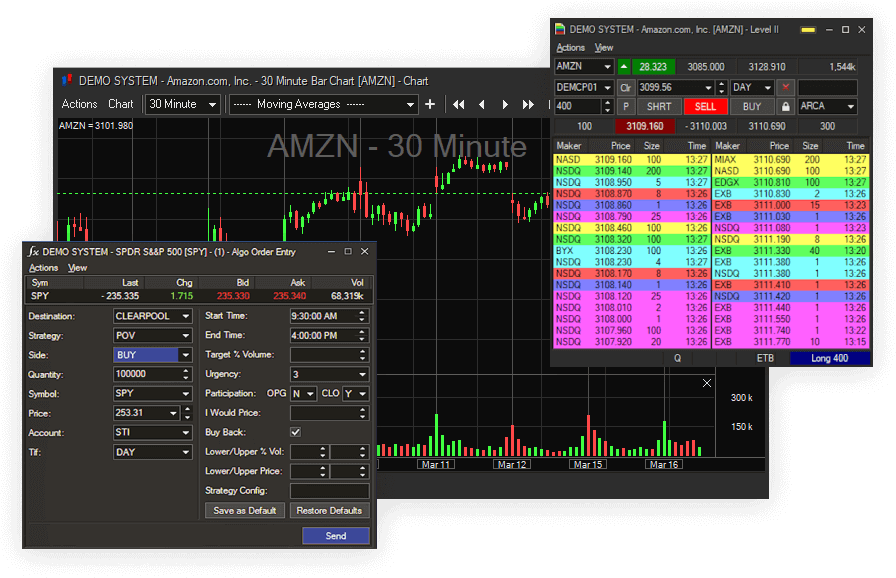

Sophisticated buy-side algorithmic trading suite with advanced order management. Sterling Trader® Elite gives institutional and agency traders complete customizable control of their trading for equities, options, complex options and futures markets worldwide.

Key platform features

Algorithmic Order Entry

Sterling Trader® Algo Order Entry allows traders to quickly and easily send orders using algo strategies. Our algo module is intricately built to the unique specifications of each algo provider. Traders can set the parameters of each order and stage those orders to be submitted throughout the trading day.

Order Desk Manager

The Sterling Trader® Order Desk Manager is an order management system to allow traders to manage equity and options orders submitted via FIX protocol from third-party systems. Executions are passed back to the client in real time. Traders can also utilize advanced block order staging for orders not submitted via FIX protocol.

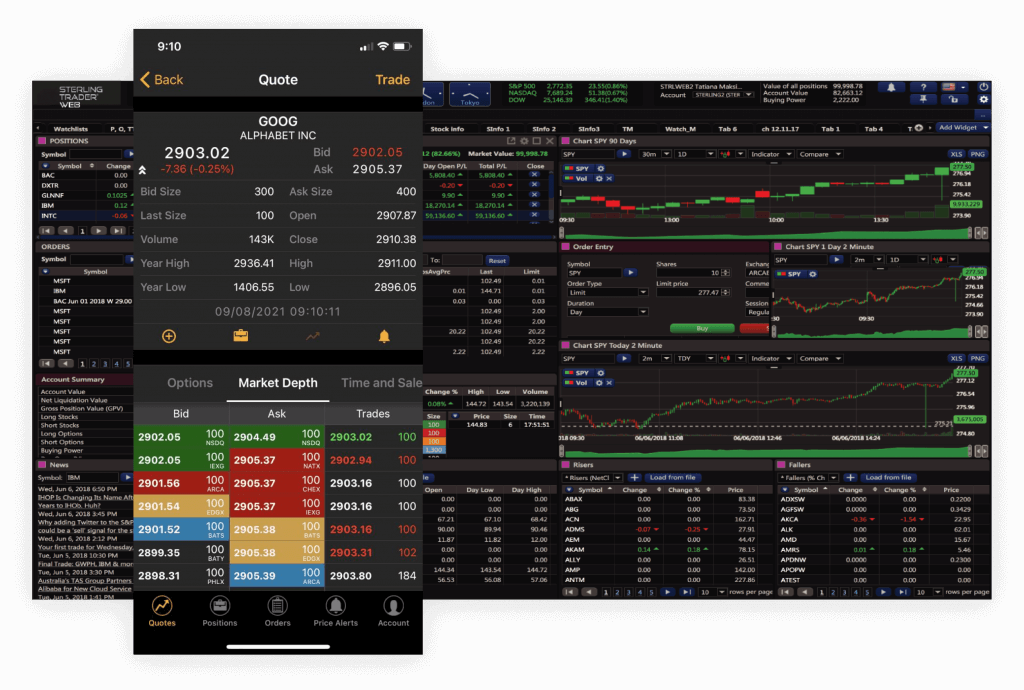

Suited for Retail Broker Dealers, RIAs & Wealth Management Firms

Step away from your trading desk with peace of mind. Sterling Trader® Web and Mobile are highly sophisticated trading platforms designed for both stand-alone use and to provide existing STT users access to the markets while they are away from their desktop application.

Key platform features

Suited for Educational Firms

Brokers, Professional Trading Groups, and Educators utilize simulation as a training tool for traders to learn advanced functionality and test trading strategies in a risk-free environment. The Sterling Trading Simulator offers a simulated trading environment for both equities and options. The Sterling Trading Simulator is available for Sterling’s flagship professional trading platforms.

Key platform features

Try the free demo

Try the free demo

Suited for Professional Traders or Active Traders at Retail Broker Dealers and Proprietary Trading Firms

The Sterling LST platform is offered to proprietary trading groups that want to trade U.S. equity and options markets. Sterling LST delivers a robust trading system to professional traders that demand highly established market data and performance. Traders of all experience levels can easily design and customize layouts and rules to best fit their trading style.

Key platform features

Suited for Professional or Active Options Traders at Retail Broker Dealers, Proprietary Trading Firms, Hedge Funds and Institutions

The next-generation analysis, execution & position management platform combining advanced trading capabilities & sophisticated risk analytics. Sterling VolTrader offers a full array of unique features for identifying trade opportunities and developing strategies. Our “what if” modeling tools provide the ability to go from modeling to execution in one keystroke.

Options Trading for Professionals

Order Execution

Sterling VolTrader delivers efficient and low latency execution from many points within the application – trade volatility directly from the skew chart; access and trade multi-leg orders easily constructed from the option montage or from the complex order ticket.

Proprietary Order-Flow Information

Increase probabilities for success through real-time order-flow statistics. Stay tuned to market sentiment, so traders have an informed context for trading decisions.

Risk, Position & Trade Analysis

Model Risk in 3D using price and volatility shocks; include or exclude modeled positions Manage position and portfolio risk drill-down by underlying security, monitor watch lists, sectors, and expiration months. View our Option Trade Cost Analysis tool directly from the Trade Blotter.

Advanced Volatility

Sterling VolTrader is known for its expertise in volatility, the single most important factor in trading options. Our proprietary IV statistics help traders make better, faster decisions.

Idea Generation

Sterling VolTrader offers a wide range of data, calculations, alerts, and visualizations that help identify strike-specific and actionable trading opportunities. Increase probabilities for success through real-time order-flow statistics. Stay tuned to market sentiment, so traders have an informed context for trading decisions.

A fully automated market data approval process solution. The Sterling Entitlement Manager quickly and efficiently allows traders to electronically sign market data agreements.

SEM Highlights

Professional Subscribers

Traders who are not employees of a firm must sign individual professional agreements directly with each exchange.

Non-Professional Subscribers

SEM captures all the data points required to verify the non-professional status of traders.

Providing risk managers with live account management, full market access and trading capability. Sterling Trader® Manager provides real-time innovative risk and trading management tools that let clients control pre-trade risk, set account limits, and manage trading parameters.

Sterling Trader® Manager offers pre-trade risk management and real-time risk control. These include everything from price thresholds (or “Fat-Finger” controls), to daily loss and buying power controls.

Manage Pre-Trade Risk & Real-Time Risk Control: Set anything from price thresholds (or “Fat-Finger” controls), to daily loss and buying power controls.

Sterling Trader® Manager delivers effective risk control and trade monitoring. Managers have access to many of the same highly valued trading tools available on Sterling Trader® Pro, but with the added features designed for managing traders and trading in real-time.

Full Market Access and Trading Capability: Access to many of the same highly valued trading tools available on Sterling Trader® Pro, but with the added features designed for managing traders and trading in real-time.

We look forward to learning more about your trading needs.